Hey there, friends. Everyone wants to know what’s going on with the real estate market now that elections are over. October was a strong month with higher sales than the previous 3 years. And builders are betting that deregulation will make it easier for them to sell homes. So, they are gearing up to build.

A blip or a bottom?

In a surprising twist for the housing market, October witnessed a 3.4% surge in existing home sales, reminiscent of a welcome autumn breeze amidst the usual economic chill. This uptick was largely fueled by a dip in mortgage rates during the preceding summer months, offering a temporary relief to potential homebuyers. Picture this as a brief intermission in a long, intense play where the audience finally gets to stretch their legs. [Source: NAR]

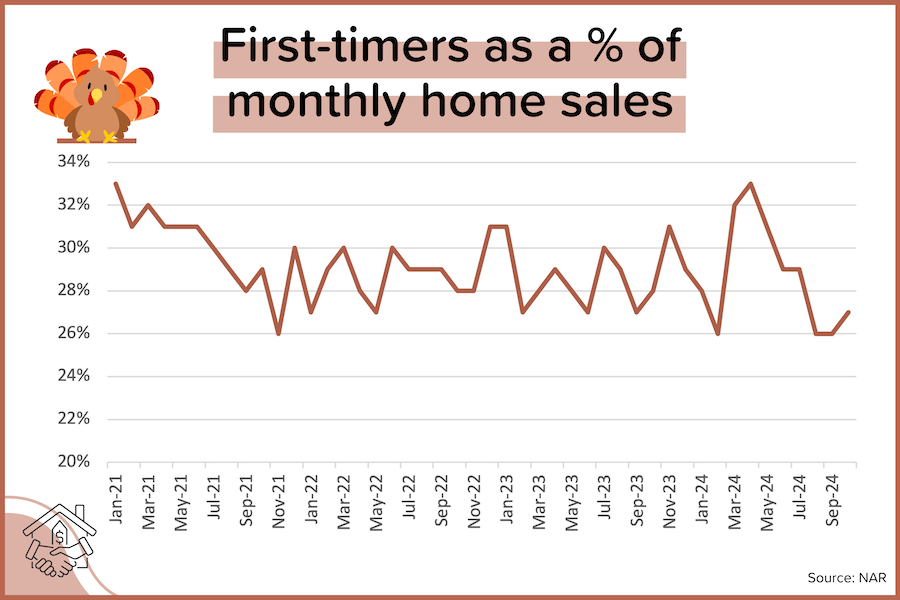

Down, but not out

Imagine the housing market as a moving escalator, previously ascending at a pace where young families and first-time buyers could hop on with relative ease. Now, that same escalator moves faster, and the steps are further apart. This has inadvertently pushed the median age of first-time buyers up to 38 in 2024, from 35 in 2023 and a youthful 31 back in 2014. This ‘pricing out’ phenomenon isn’t just a footnote in economic reports; it’s reshaping the dream of homeownership into a marathon for many, delaying their start on the property ladder by years. [Source: NAR]

Staying above 7%

In this climate of economic jitters, the Fed Funds Rate futures market has tightened its grip, betting with even odds on whether the Fed will dare to cut rates at the next gathering on December 18th. Meanwhile, the housing sector feels the squeeze, with 30-year mortgage rates stubbornly hovering above 7%, transforming what was once an attainable dream into a distant horizon for many potential homeowners. [Source: CME, Mortgage News Daily]